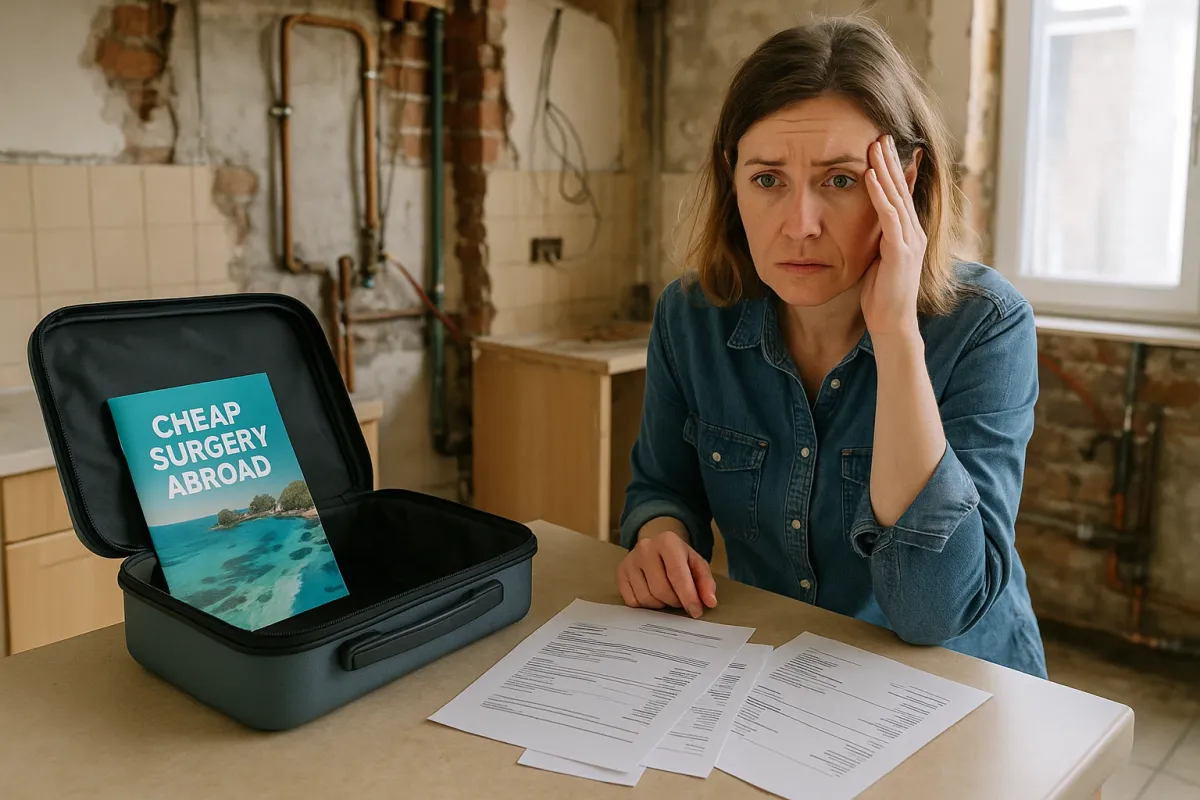

When a 31-year-old mother was placed on life support after flying to Vietnam for cut‑price plastic surgery, the story ricocheted across today’s news cycle as another cautionary tale about medical tourism and the hidden costs of “cheap” transformations. Reports note she was inspired by Kylie Jenner’s look and sought a dramatic, rapid change overseas—only to face devastating medical and financial consequences instead.

For discerning homeowners, the parallels with renovation planning are striking. In both elective surgery and home transformation, the most expensive outcome is rarely the initial price tag—it’s the cost of correcting a rushed, under‑researched, or bargain‑obsessed decision. The headlines are talking about operating rooms and intensive care; at Renovate Quotient, we see the same psychology playing out in living rooms, kitchens, and façades every day.

Below are five exclusive, budget-focused insights drawn from the logic behind this real‑world story—refined for homeowners who want beautiful results without gambling with their most valuable asset.

1. The Illusion of the “Incredible Deal” – And Why True Value Is Never Just a Number

The woman’s trip to Vietnam was reportedly driven by the promise of a lower price and a dramatic aesthetic shift. On paper, it looked like a savvy financial move: why pay Western‑clinic prices for a similar procedure? In practice, the “savings” evaporated the moment risk, aftercare, and complication costs entered the frame.

Renovation budgets suffer from the same optical illusion. A contractor who underbids by 20–30% can look irresistible in a comparison spreadsheet, especially if you’re scanning only the “Total” line. Yet that number hides a series of quiet questions: What corners are being cut to reach this price? Is there contingency built in? Are insurances, permits, and warranties fully costed, or simply implied? Just as with overseas surgery, the discount is often achieved by stripping out infrastructure you can’t see but will absolutely pay for later—through delays, rework, legal disputes, and premature replacement of failing materials. A premium budget mindset doesn’t chase the cheapest quote; it pursues the most transparent, fully loaded one.

2. Risk Has a Price: How to Budget Like an Underwriter, Not a Dreamer

In medical tourism, governments and insurers warn repeatedly about the “hidden” costs: emergency repatriation, extended hospital stays, lost income during recovery, and long-term complications. None of that shows up in the glossy “before and after” photos—or in the package price advertised online.

A sophisticated renovation budget treats risk the same way an underwriter would. It starts with a frank question: “What is the financial consequence if this goes wrong?” Then it prices that risk into the plan. This means allocating a minimum 10–20% contingency on complex projects, but also structuring your contracts to cap potential damage: clear defect liability terms, staged payments tied to verified milestones, and explicit allowances for cost escalations in materials. When you consciously price risk into your budget, you stop being surprised by “unexpected” costs and instead operate like a serious investor protecting capital—because that is exactly what you are.

3. The Problem with Aspirational Copy‑Paste: Designing Beyond Celebrity Kitchens and Trend Feeds

The surgery case was driven, in part, by an aspiration to mimic a celebrity transformation—Kylie Jenner’s highly curated aesthetic. It’s an emotional shortcut: if I can look like that, I’ll feel like that. Yet bodies, health baselines, and lifestyles are profoundly individual. What works for one person can be catastrophic for another.

Homeowners quietly fall into a similar trap with renovation inspiration. A Parisian loft on Instagram, a Malibu kitchen on Pinterest, a London townhouse bathroom on a streaming series—beautiful, but optimised for different climates, building typologies, and daily patterns. Importing those details wholesale, without contextual adjustment, often explodes budgets later: overheating glass boxes in hot climates, imported finishes that need specialist installers, or layouts that fight the actual bones of your property. A premium budget is not just a ledger of costs; it is the financial expression of a design strategy that fits your house, your lifestyle, and your local conditions—not someone else’s highlight reel.

4. Due Diligence as a Line Item: Why “Research” Belongs in Your Actual Budget

One thread in today’s coverage of the surgery incident is the question of due diligence: How thoroughly were the clinic, qualifications, and emergency protocols vetted? Were independent medical opinions sought, or were decisions anchored in social media testimonials and glamorous “after” photos?

For renovation, due diligence deserves an explicit place in your budget, not just your intentions. This means setting aside real money for pre‑project investigations and professional advice: structural surveys, building envelope assessments, independent quantity surveying, and third‑party design reviews. It may also include paying for multiple detailed, itemised quotes instead of relying on free, sketchy estimates. While this line item can feel like overhead, it frequently pays for itself several times over by preventing mis‑scoped works, change orders, and avoidable structural surprises once walls are opened. The most refined projects often spend more up‑front on understanding, so they can spend less later on firefighting.

5. Exit Costs and Aftercare: Budgeting Beyond “Completion Day”

The tragedy of the current surgery headline isn’t only the emergency itself—it’s the open‑ended aftermath. Long‑term rehabilitation, future interventions, the emotional and financial toll on family: these are the true, enduring costs of a decision that was priced only to the day of the procedure.

Renovations carry their own version of aftercare economics, and they rarely make it into the initial budget. A sophisticated approach deliberately allocates funding and planning for life after handover: fine‑tuning building systems, scheduled maintenance for premium finishes, professional cleaning of stone and timber, and periodic inspections of waterproofing and roofing. It also includes a realistic buffer for living costs during and after the project—temporary accommodation, storage, eating out more often while the kitchen is offline, and the inevitable small purchases once you reoccupy (window treatments, bespoke joinery inserts, upgraded hardware). When you cost in aftercare, your renovation doesn’t just look finished on day one—it remains effortless and elegant years later without surprise cash infusions.

Conclusion

Today’s headline about a young mother on life support after seeking a cheaper, faster path to transformation is, at its core, a financial parable as much as a medical one. It illustrates, in stark and human terms, what happens when the visible cost eclipses the true cost, when aspiration outruns due diligence, and when risk is treated as an abstract rather than a line item.

For homeowners planning a renovation, the lesson is not to retreat from ambition, but to fund it with the same seriousness you bring to any major investment. Budget not only for what you can see, but for the risks, the research, and the refined life that follows completion. Do that, and your home—unlike today’s tragic story—becomes a testament to considered transformation rather than a cautionary tale.

Key Takeaway

The most important thing to remember from this article is that this information can change how you think about Budget Management.